Introduction

The music industry seems today to be at the forefront of the technological changes linked to blockchain: after having experienced many difficulties in the 2000s because of the digitization of content, of production tools, and distribution channels, the historical players in the market are trying to understand and tame this technology, motivated by the arrival of new entrants offering new solutions for intermediation between artists and consumers.

The blockchain can be likened to a ledger distributed to all its users through a chain of time-stamped blocks of information that follow one another: each new transaction is recorded by adding a new block to the existing chain. To guarantee the integrity of the register, the blockchain uses cryptographic hash functions, which allow a kind of digital signature of the recorded information. Each block is identified by a unique sequence of characters generated by the hash function and is “chained” to the block that precedes by including in its own hash calculation the hash of the previous block, and so on, like Russian dolls. This successive interweaving of blocks by the interpenetration of outputsofthe hash function allows to protect the information contained into the blockchain.

The distributed nature of the blockchain allows a trustlesscertification of exchanges. The data is also said immutable since once it has been validated in the chain, it is impossible to modify or delete it. Moreover, as each member of the network has access to the register, the information concerning the history of transactions is necessarily complete and transparent.

Moreover, this trustlessaspect is extended by the existence of smart contracts, leaned against certain types of blockchains such as Ethereum, consisting of the automatic execution of clauses encoded into the blockchain. As soon as the conditions set out in the clauses are fulfilled and recorded in the blockchain, none of the parties can object to its execution, thus saving the costs of monitoring the proper execution of the contract by the trusted third party. More generally, smart contracts facilitate exchanges between parties who do not know each other, since each knows that the other will automatically perform its obligations.

In economic terms, blockchain is thus seen as a tool that reduces the various “transaction costs” that are currently supported by intermediaries: information gathering, negotiation, signatures and execution of contracts, etc. In the case of the music industry, these transaction costs are particularly high and give birth to a whole series of inefficiencies and conflicts between players. This is due, among other things, to the multiplicity of rights and contracts governing the sharing of value (copyright and neighboring rights) and to the complex administrative and technical procedures for its recovery through databases scattered among different intermediaries (phonographic producers, publishers, collective management organizations, etc.).

In this context, the blockchain promises among other things a more direct, transparent, and individualized remuneration of artists, de facto eliminating most of the activities performed by traditional intermediaries, especially those related to the management of intellectual property rights. However, a close examination of the technology and the music market leads to nuance the plausibility of such a scenario. Without denying its ability to streamline many aspects of the industry’s intermediation process, blockchain appears more as a new way of creating and capturing value in the marketplace than as a tool for radical disintermediation.

Applications to the music industry

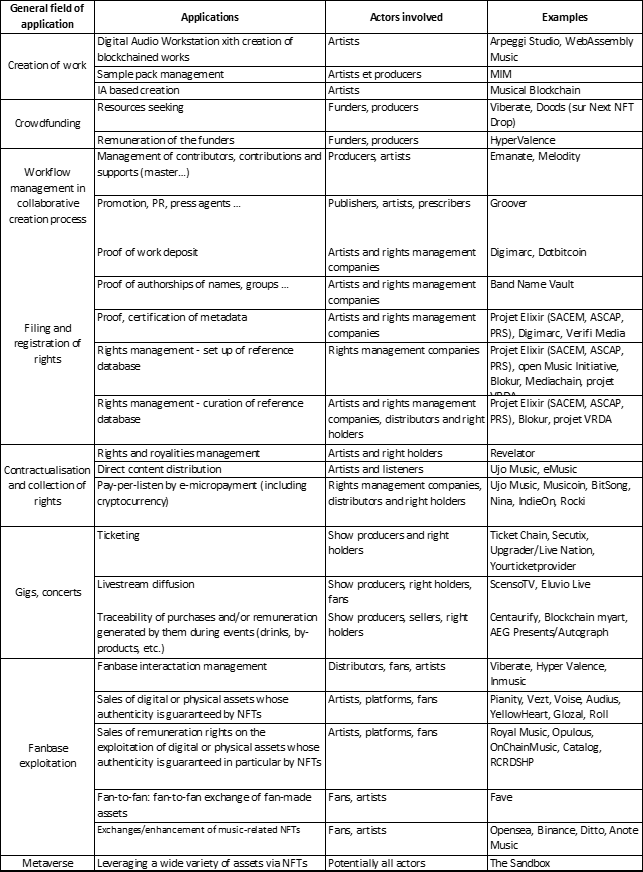

The applications of blockchain are extremely varied and have quickly covered almost the entire spectrum of the music industry, in the same way that digitization had gradually spread to all these activities during the 1990s and 2000s (see Table 1). The emergence of NFTs (non-fungible tokens) further strengthened this spread and above all led to the combination of uses of blockchain that had previously been partly compartmentalized.

While it is possible to find interesting and sometimes innovative examples of applications for crowdfunding, in management of the creative process workflow,1Management of contributions and contributors to recording, mixing, mastering, sampling, etc.and in artistic creation itself, it appears that the bulk of applications is concentrated in four areas, the boundaries of which are becoming increasingly blurred by the development of NFTs offers for combinations of digital and non-digital assets, and by the development of multiservice platforms.2Most applications use the Ethereum protocol, which is well documented on the web and for which development support is provided by a large and active community. Bitcoin is more rarely used, as are proprietary solutions and, more recently, a coupling between Solana blockchain and Arweave storage system.

Filing and registration of duties

One of the first applications of blockchain in the music sector is to serve as a technological architecture to build a single, harmonized, and transparent global repository of all intellectual property rights (copyrights and neighboring rights) and associated metadata. Indeed, one of the main problems related to the construction of such a single and integrated database is the lack of trust between the different stakeholders. However, as previously mentioned, the trustlessproperties of the blockchain guarantee that each party will follow the governance rules of the database without the need to invest in a trusted third party certifying compliance with these rules.

At the very least, and subject to a law change, the blockchain could thus be a secure and effective means of recording artists’ rights, usable as proof of authorship (essential in case of a conflict in the claim of rights), thanks to the creation a unique and time-stamped digital print linked to its digital signature. The Band Name Vault organization, for example, offers to record the names of artists or music groups in the blockchain; more broadly, watermarking services3Watermaking creates and links to the audio file a dotBC URL referring to a series of minimum viable data (such as song title, artist, publisher, ISRC, ISWC, etc.) stored into the blockchai are proposed by Digimarc, for instance.

New ways of contracting and collecting rights

Blockchain technology, combined with smart contracts, may also be able to complement several existing proprietary solutions for managing intellectual property rights. One example is the ContentID technology developed by Google and used on its online video platform YouTube, which identifies matches between content uploaded by users and copyrighted content. Currently, copyright owners enforce their rights through a notice and takedown requests system (N&TR) when they think their content identified by ContentID is being used. However, this system is strongly criticized for its inflexibility, especially for users making creative use of protected content. Moreover, rights holders do not have direct and transparent access to the data and revenues generated by their content. Finally, both rights holders and users are dependent on the often opaque and complex usage policy of the trusted third party and are thus exposed to the uncertainties associated with a misunderstanding or unilateral modification of this policy.

The blockchain would save the costs and inefficiencies generated by the trusted third party by making the N&TR system more fluid or even replacing it with a smart contract system,i.e., pre-agreed and self-executing rules into the blockchain. By doing so, the parties would not only save the costs of the N&TR system but would also generate new business opportunities. Smart contractswould indeed allow a wider range of contractual possibilities for the rights holder by encoding personal license agreements (instead of the “generic” licenses of the N&TR system) and adapting to each use of music, including streaming consumption. Indeed, the low transaction costs of cryptocurrencies make micropayments possible that remunerate owners for each listening of their music content. The now canonical example of Imogen Heap immediately comes to mind: the artist marketed her single Tiny Human through the Ujomusic platform, which is based in the Ethereum blockchain. The single was broken down into “stems” corresponding to the recording tracks per musician. The selling price of the track depended on the stems purchased, and the usage made by the buyer, $0.6 for a single download, $45 for a remix, and $0.06 when streaming. In addition, 91.25% of the revenue generated went to Imogen Heap, 1.25% to her musicians, and the rest to the platform.4For a detailed description of the operation, which, with a total revenue of $133.30, ended in commercial failure attributable to the immaturity of both the technical side and listener purchase patterns, see ConsenSys Media, “Evolution of Ujo Music: The Tiny Human Retrospective,” November 7, 2016, online: https://media.consensys.net/evolution-of-ujo-music-the-tiny-human-retrospective-e23136197c31

Applications around concerts

Ticketing has also emerged as a prime field of blockchain application. Next to physical tickets, e-tickets to be printed or m-tickets to be checked on a smartphone (all three requiring a barcode or a QR code), the blockchain ticket does not require any code. Indeed, this system permits the creation of a fully digital and nominative ticket, i.e., with a unique identifier for each ticket, which is stored in the virtual walletof thebuyer. Each ticket purchased is therefore associated with the owner of the wallet, making it tamper-proof and incorruptible. Moreover, the transaction history can become fully traceable and transparent, and even controllable by adding smart contractsdefining the authorized conditions of resale. We can therefore see the interest of such technology to fight against falsification, to secure tickets, and to ensure a nominal control of the holder without requiring any ID, but also to control the market of resold tickets. One of the most publicized examples was the release of blockchain tickets for Ed Sheeran’s June 2022 concert series in Paris. Complementary applications have also emerged to ensure the traceability and/or remuneration generated by “classic” purchases during concerts (drinks, merchandise, catering, etc.).

Relations with fans: towards a token economy?

Blockchain would also allow artists to solicit and deepen relationships with their audiences, with the (non-exclusive) aim of funding or making a living from their music projects more easily. Several players have thus quickly proposed the use of blockchains, such as Viberate or HyperValence. But if this field has seen a flowering of projects in the last one or two years, it is mainly through the purchase of crypto assets by fans, allowing them to get access in return to various rights and rewards granted by the artist and managed by smart contracts. These crypto assets are said to be non-fungible in that they are unique and non-interchangeable (unlike a “monetary” crypto asset) and take the form of digital “tokens”, NFTs. In this case, most NFTs issued in the context of music projects are described as social tokens insofar as they reflect the existence of a community link between an audience, willing to pay to finance a project, and the artist wishing to realize and promote the project.

In some ways, the NFT funding system for art projects is like crowdfundingsystem. However, in addition to potential savings in transaction costs (although some of these costs are reflected in gas fees5The gas is the unit in the Ethereum blockchain paid by the user who wishes to make a transaction, to the miner who validates the transaction according to the consensus provided by the Ethereum protocol. The cost of the transaction is calculated according to the computing power necessary to carry out the operation. This system of operation of the Ethereum blockchain can be compared to the way an electricity bill is calculated: each use of a household appliance is associated with a certain amount of electricity consumption expressed in kilowatt-hours (the gas) which finds its equivalent in euros (the price of the gas, expressed in fractions of ether, called gwei)., the use of NFTs and blockchain would allow artists to imagine a much more precise and varied system of fan rewards and incentives than the current system. As the tokens are unique, they can refer to objects in the digital world as well as to assets in the physical world: images, music, or unreleased and NTFized videos (for example, pieces of Booba’s video clip put on sale for €70), access rights to private chat rooms with the artist, concert tickets, discount coupons for vinyl or merchandising items. Some NFTs even give the right to a fraction of the income generated by the artist’s copyrights, like the musician Jacques, who transferred 0.51% of the exploitation rights of his song Vous via NFT. Some of these NFTs can be resold, sometimes on the platform where they are created and put on sale, sometimes via NFT marketplaces such as OpenSea or Binance. This activity inevitably attracts intermediaries such as ANote Music, which offers exchanges for NFTs on entire repertoires, or digital aggregators such as Ditto, which, with its Opulous financing platform associated with Binance, offers artists the opportunity to exchange NFTs on future rights for sources of financing.

Ticketing is often one of the anchors of these bundles (or asset bundles) offered as NFTs. Centaurify is one of the pioneers of such applications. One of the most recent and high-profile examples of this trend is the release of Kings of Leon’s latest album, which, in addition to a standard release on streaming platforms, was also packaged as an NFT with additional content for fans, including lifetime access to the band’s concerts or “ownership” of a unique piece of digital art related to the band’s world. Similarly, it is now about linking the “physical” concert experience with “NFT-able” assets partly created for the occasion, such as personalized posters or artworks created in public during a festival (see the agreement between concert organizer AEG Presents and web3 solution specialist and NFT Autograph).

Not surprisingly, the exploitation of nostalgia and the sacredness of some key events, often associated in fans’ minds, is also a privileged field for the development of NFTs. The examples of the sale of NFTs of Beatles memorabilia (original lyrics’ manuscripts, clothes, guitars, etc.) by John Lennon’s son, the recent agreement between Billboardand Universal to publish NFTs linked to milestones marking Billboard’s 50th anniversary, or the agreement between the NFT trading platform Binance and the US Recording Academy to issue NFTs during the Grammy Awards are fairly representative of this phenomenon. In some ways, the ultimate outcome of these fan-based approaches is the development of fan-to-fanapplications such as Fave, through which fans themselves build and trade assets related to their favorite artists, not always with formal validation from the artists, and sometimes with remuneration of them.

To sum up, blockchain would allow artists to create a tokeneconomy around their musical universe through new objects and new relationships with the audience. There’s a clear link with the development of the creator economyin which artists would directly propose to fans to subscribe to get specific assets of very varied natures. This trend is currently relayed by a multitude of applications, some of which are not strictly speaking in the music sector (Instagram, Twitch, Patreon, Twitter, and TikTok of course). Note that, without necessarily using blockchain, one of the sources of fan support, namely their visibility as fans and their feeling of belonging to a community, is also enhanced by the virtual fan badge system offered, in addition to streaming services, by platforms such as Audiomack.

This tokeneconomy built around artists could ultimately be built around DAOs (Decentralized Autonomous Organizations), i.e., communities to which individuals subscribe by purchasing tokensand whose operating rules are written into the blockchain. DAOs can be likened to decentralized organizations in which the decision-making and rewarding process of stakeholders are immutably inscribed in the blockchain and whose “shareholders” are, among others, and according to the conditions provided, the holders of associated tokens. The blockchain would thus constitute the technological infrastructure of a new decentralized Internet, known as Web 3.0 or the “web of ownership”, as opposed to today’s Web 2.0, which is centralized around the GAFAM. Web 3.0 thus corresponds to a new organizational ethos based on a direct, transparent, and community relationship between the parties. From this perspective, tokensare no longer just a mechanism for “free” rewards granted by the artist or the counterpart of a crypto-currency flow, but a full-fledged governance tool. For example, members of a DAO could be rewarded with tokensfor their virtuous activities or behaviors (according to terms written in advance and automated into the blockchain) allowing their holders to participate in the organization’s decisions or to signal their skills and involvement to other stakeholders.

Finally, we cannot close this brief overview of the extremely varied field of blockchain applications in the music domain6We could add to this panorama the applications supporting the development of the Internet of Musical Things (IoMusT) suggested by L. Turchet but for which we have not yet found any exemplary application. See Marellapudi T. S., “What is the Internet of Musical Things (IoMusT)?”, All about Circuits, April 24, 2020, online: https://www.allaboutcircuits.com/news/what-is-the-internet-of-musical-things-iomust/without mentioning the convergence with the development of the metaverse7Evolution of the Internet towards a virtual world, based on 3D computing, virtual and/or augmented reality, made up of shared and persistent spaces where users interact via avatars.. In a way, in addition to what is exclusively produced in this space, everything that is subject of NFTs in the “current” world could be reproduced in parallel in the metaverse. Many examples are emerging: not only sharing a moment with an artist, but being their neighbor in a metaverse (e.g., hanging out with Snoop Dogg in the metaverse The SandBox thanks to NFTs sold for $458,000); tickets to virtual concerts secured by NFTs; creation of NFTized music artist avatars and music-related digital apparel (Warner Music/Genies deal); launch of 10,000 Snoop Dogg avatars via NFTs; creation of Kingship, a virtual-only band consisting of four musicians and their manager created as NFT images, launched by Yuga Labs and bought by Universal, and so on.

The limits of blockchain for the music industry

The examples above demonstrate that blockchain technology already offers many opportunities for change and business in the music industry. However, there are also many limitations to this technology, both technical and related to the specificities and needs of the music industry. The first and most frequently mentioned problem is the lack of incentive for the industry’s main traditional players to invest money and effort in building such a single, decentralized, and transparent database of the entire music catalog. On one hand, such an initiative would be likely to call into question some processes and business skills, especially if such a database were to be completed by a smart contractarchitecture. On the other hand, the public and transparent nature of such an architecture may compromise part of the business models of these intermediaries, which are precisely based on the complexity of the rights management system. Added to this is the lack of standardization and the dispersed (or contradictory) nature of the data, or even the absence of data, for a significant number of titles, including recent ones, thus increasing the costs to be invested upstream in order to achieve a complete register.

However, this lack of incentives alone cannot explain the difficulties associated with the creation of such a register. The main problem is the sharing of metadata between the main actors and intermediaries (OGC, publishers, labels, etc.): all of them underline the difficulty to agree beforehand on the rules and procedures that should govern the construction and maintenance of such a register (which types of data according to which standards and with which access and which procedures for additions, for deletions?). These rules are even more important to determine as the blockchain, by its very functioning, is a so-called append-only database, i.e., in which it is only possible to add data, not to delete any. This immutability of the system is usually virtuous as it prevents malicious attacks aimed at performing cryptocurrency “double spending”. However, the cryptocurrency is completely endogenous to the blockchain it is leaned against, it does not represent anything other than itself. Conversely, music metadata represents a legal reality that is entirely exogenous to the system. Yet there is no guarantee that chained data is legally correct. Indeed, the blockchain only allows attesting the validity of issued data (who declared which data and when) but not its veracity (what is declared corresponds to what is legally recognized).

Without adequate governance rules, a public blockchain can easily lead to a “garbage in, garbage out” problem. The decentralized streaming platform Audius has been challengedby rights holders because it allowed its users to access pirated music content uploaded on the IPFS decentralized storage and distribution system used by the company. Without going into technical details, the problem can be summarized by the fact that Audius can’t remove the offending content from IPFS network nodes that do not comply with their request, preventing the platform to complying with the rights holders’ requests. This example highlights the need for these next-generation platforms to create an ex-ante verification mechanism for uploading music content to their systems, such as Google’s famous ContentID, and thus to combine their blockchain solutions with more centralized technologies and procedures. Similarly, there is the question of correcting or even deleting the data issued by these platforms to guarantee the application of the right to be forgotten or the moral rights of repentance and withdrawal. Such interventions on the register imply, once again, a form of centralization that could call into question the trustlessproperties of the blockchain and therefore the interest of such a technology.

More generally, there is currently a real question concerning the ability of blockchain to adequately translate complex contractual relationships, such as those organizing the music industry, into smart contracts. Two problems need to be considered. Firstly, as mentioned before, when the conditions of the contract depend on data exogenous to the blockchain, the parties must ensure the quality and reliability of the “phasing” between the off-chain reality and the on-chain data triggering those conditions. Such work may require new trusted third parties, called “oracles”, which may take more or less centralized forms. The second problem is the automatic nature of smart contracts. Smart contracts by definition only execute the terms that the parties have explicitly agreed to. However, the parties cannot foresee all the contingencies and circumstances that govern their transaction. Some clauses or legal realities are based on semantic ambiguities that allow the contract to adapt to new circumstances. In other words, contracts are always “incomplete” and must be able to support a certain degree of flexibility that is impossible to achieve in smart contract modeling without additional costs. Depending on the nature of the contract in question, the use of smart contractscould therefore either reduce or increase transaction costs.

Even more critically, the use by traditional organizations (or artists) of blockchain solutions to optimize their processes or generate new value propositions (via NFTs and smart contracts, for example) requires the use of intermediaries specialized in the analysis-design-implementation of those solutions, thus creating again the problems of trust and transactional costs mentioned before. From this point of view, blockchain seems to change the way intermediation activities are carried out rather than simply eliminating them. As the sector is still unregulated, it is even more difficult for these organizations to know the seriousness and technical reliability of the suggested solutions, thus exposing them to significant technological and economic risk. As an example, we can mention the hack of the Roll platform, a platform which allows artists to easily create social tokenson the Ethereum blockchain in a very personalized way. The amount of tokensstolen was estimated at over $5 million. This steal was made possible by a security breach in the company’s blockchain infrastructure protocol.

Note that this lack of reliability of these new activities is not only technical but also, and above all, legal. Some cases of NFT use, especially those giving the right to a fraction of the revenue generated by a musical title, present numerous legal uncertainties. Often misrepresented as an on-chainproperty rights on the master of the work, these tokensare rather rights to receive a part of the revenue streams generated by the title without any effective transfer of ownership. It is therefore impossible to use the work to perform a remix, for example, or to authorize its use by a third party. Moreover, only the flows to which the author is entitled are concerned, which may vary according to numerous circumstances (public performance, streaming, radio broadcast, synchronization, etc.) and the territory in question. Note that, for now, all of these revenue streams are made off-chain, which raises the question of how they are collected by NFT acquirers (via what type of currency or cryptocurrency, according to what payment’s frequency, etc.) and how transparent they are. Finally, there is a legal vagueness around NFTs: are they full-fledged financial assets, and of what nature (utility tokens, security tokens)? Other regulations and legal limits should be considered in addition to the copyright framework.

Finally, in the continuation of previous remarks, it is important to nuance the capacity of blockchain to produce new modes of governance and new forms of decentralized organizations. For now, most organizations and collectives claiming to be DAOs in the music industry do not always use blockchain to “self-govern”. In other words, and quite paradoxically, the rules and modes of governance that frame the life of these organizations are not formalized and inscribed into the blockchain but use traditional web tools such as Discord or internally developed tools. One possible explanation for this is the youth of these organizations, which must first consolidate and clarify their objectives through experimentation and discussion before formalizing stable and well-defined rules. Even once these objectives are firmly established, the most effective rules of governance will likely emerge through a process of trial-and-error selection. This is likely to be a long and arduous process, as evidenced by the recent so-called “governance” attacks by some DAOs operating in the decentralized finance sector. The aim of these attacks is not to take advantage of a technical breach to steal crypto assets, but rather to misuse or hijack the DAO’s governance rules to gain control by gathering a critical mass of votes. In the long run, and ironically enough, it is not to be excluded that these multiple experiments will lead to governance rules that include a certain degree of verticality.

A final limitation relates to the uncertainty associated with the highly speculative nature of cryptocurrencies and the tokeneconomy. This uncertainty is expected to diminish with the emergence of standard use cases and solutions such as stablecoins indexed to “traditional” currencies.8The rationale for stablecoins is to take advantage of low volatility, for example through indexing to traditional assets (monetary or otherwise). However, this indexation creates problems of transparency and confidence in the commitment of issuers to ensure the stability of their stablecoinsby having sufficient reserves of assets.

Scenarios

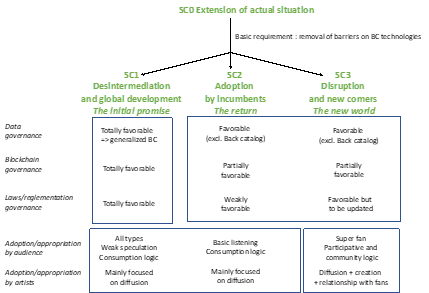

A prospective exercise on the impact of blockchain technology on the music industry requires the identification of key parameters9About forty parameters were thus identified and gathered into seven main categories: The possibilities and limits of blockchain technology (computing capacity, time required for consensus proofs…), the governance of blockchains (possibility of ex-post correction, interfacing of platforms…), the governance of music industry data and metadata (standardization, quality control at entry…), the legal and regulatory framework of blockchains (stability or harmonization of tax rules on the resale of NFTs…), other regulatory aspects (evolution of copyrights…), adoption and appropriation behaviors by fans and adoption and appropriation behaviors by artists. and possible evolution scenarios. The maturity of the technology and the removal of its technical limitations identified above are obvious conditions for its adoption by various stakeholders. However, other categories of parameters, notably related to the governance and regulation of the music industry and the technology, must be considered. In addition to a basic scenario that constitutes an incremental evolution of what exists, we identify three more or less disruptive evolution scenarios.

Scenario 0 (short-term projection): evolution of the existing system with minimal regulation and new business models for emerging players

This scenario is an extension of the current situation, considering that the construction of a single, standardized database of a worldwide (or at leastEuropean) musical repertoire is a too difficult challenge for the industry to meet in the short term. Under these conditions, the advent of blockchain does not lead to a profound change in the way the music industry operates. The value chain remains schematically organized, upstream by independent labels and publishers, and majors, and downstream by Web 2.0 streaming platforms.

For the past few years, the opportunities provided by blockchain have been focused on end-to-end on-chain applications (such as the sale of NFT objects), as opposed to applications requiring the integration of off-chain data streams (such as tokensentitling to some revenues generated from a traditional streaming platform). In the absence of reliable phasing between the off- and on-chainworlds, these more innovative applications remain anecdotal in addition to being legally unclear. Thus, blockchain does not radically transform the value proposition of the established players but juxtaposes with their existing offer by providing new services around certain types of NFTs, especially those related to music files and digital merchandising elements or leaned against specific off-chainservices such as real concerts or concerts in the metaverse.

In line with the observations of the previous section, these new offerings are leading to the emergence of intermediaries that take on the design and implementation of NFT strategies and eventually act as buying and trading platforms. This point can be illustrated by the partnerships already underway in the industry, including by the majors.10See the agreement between Universal and the NFT Curio platform, or between the blockchain video game The SandBox and Warner. In the long term, it is possible to imagine that part of these activities could be internalized by labels or artist support companies with a sufficiently large financial base in order to better coordinate them with their traditional activities in a renewed 360° strategy.

The blockchain also helps to make the so-called “long tail” viable11Anderson C., “The Long Tail,” Wired, October 1st, 2004, online: www.wired.com/2004/10/tail by allowing independent artists with smaller audiences to increase fan engagement through various NFT services and strategies. Subject to the limitations mentioned before, these artists would have even less difficulty in making clever and innovative use of the tokeneconomy as they are often in full possession of their copyrights and neighboring rights, with an intense learning and experimentation phase that the more established players can then capitalize on.12Hu C. and Jackson B., “Music/Web3 Dashboard: $160M + worth of music NFT sales, plus music DAOs and creator tools”, Water & Music, January 9, 2022, online: www.waterandmusic.com/data/music-web3-dashboard/The intermediation of these artists also takes place through specialized NFT platforms. However, it is possible to imagine a broadening of the services offered by these platforms to artists by aligning themselves with an intermediation offer close to those of the already established players, but with processes that are partly based on blockchain, following the example of the labels or DAO organizations mentioned before. Part of the artist discovery and promotion/curation activities of these organizations are thus outsourced to communities of users, possibly remunerated and/or rewarded in cryptocurrencies and social tokens.

Scenario 1: Disintermediation with the global development of blockchain

In this first scenario, the development of blockchain technology leads to radical disintermediation of the music market by reducing, or even eliminating, the old intermediation processes operated by traditional players (labels, CMOs, platforms, etc.). This scenario refers to the initial promise of blockchain, formulated at the end of the 2010s, allowing artists and rights holders an individualized, automatic, and transparent mode of remuneration as well as a sharing of the value created that would be more favorable to them.

In this scenario, music consumption switches from a freemium streaming model (subscription managed by a centralized 2.0 platform, e.g., Spotify) to a pay-per-listen model supported by a series of smart contractscoded and validated by one or more decentralized DAO-type platforms. Each listening of a musical track generates a transaction registered into the blockchain that remunerates the artist and/or the rights holders through a micropayment system in cryptocurrency. The automatic and transparent nature of the execution of “on-listening” contracts thus allows a considerable reduction in transaction costs. The intermediation activities in this new market essentially boil down to the creation and maintenance of user-friendlyinterfaces allowing artists and rights holders to put their musical content online and consumers to have easy access to the entire global musical catalog.

Due to the existence of network externalities, we can anticipate a strong concentration of these platforms, as is currently observed in streaming. However, in this scenario, the platforms operate as DAOs governed by stakeholders (creators, consumers, curators, developers, financiers, etc.) whose roles and prerogatives are written into the blockchain. Given the experiments underway, it is possible to consider governance rules that leave a little more room for the initiative of the auditors, like the system of the company Pianity, which “outsources” to its community of users one part of the activities of discovering artists through a system of voting and cryptocurrency rewards. In the long run, only platforms that have been able to set up rules allowing a virtuous incentive system to develop and maintain the network would survive and dominate the market.

Upstream of the value chain, new musical creations are systematically recorded in the blockchain according to standardized procedures allowing better traceability of works and a better indication of their authorship. The creative process itself is impacted by the successive chaining of different creative activities (composition, interpretation, mixing, etc.) remunerated by smart contracts depending on the recording of outputs into the blockchain. Platforms dedicated to the recording and referencing of musical inputs (lyrics, musical loops, etc.), beatmakersand ghostwriters, or AI resources are developing as registers sanctioning the authorship or even the terms of use of these inputs by smart contracts. These platforms thus reinforce the crowdsourcingpractices already noticed in the industry, particularly among certain artists from the urban/pop genres operating in the “Hook&Tracks”13Seabrook J., The Song Machine: Inside the Hit Factory, New York: W.W. Norton & Company, 2015. mode, while promoting a new distribution of value to the advantage of the creators of these inputs.

Downstream of the value chain, streaming platforms (and the activities of associated aggregators) are probably the big losers, being overtaken by the emergence of new players offering more attractive remuneration methods to artists (more favorable distribution, transparency, automaticity of flows, etc.) while leaving room for co-creation and “empowerment” of users due to their decentralized nature. Conversely, it is possible to consider a certain resilience of music labels and publishers. Indeed, these intermediaries contribute directly to the creation of value through activities related to artistic direction, artist career management, marketing, and communication operations, etc. In addition, some purely legal and transactional skills remain residually important, particularly in physical distribution activities (sales of CDs, vinyl, etc.) due to the existence of physical flows that are exogenous to blockchain systems and solutions. However, these traditional intermediation activities are strongly impacted by blockchain, with increased use of outsourcing via smart contracts.

The majors continue to play a substantial role due to the size of their back catalog, allowing them to maintain significant market power over downstream supply chain players and thus negotiate more attractive rates with distributors, including community platforms deployed in the blockchain. On the other hand, the lower transaction costs and new business opportunities created by blockchain increase the competitive pressure on the latter by helping to viable the so-called “long tail” in which a growing number of niche artists and independent labels are developing profitable tokeneconomies despite more confidential streams of listening (and thus revenue) on platforms. More generally, NFTs serve as an incentive and reward mechanism for fans who contribute to the artist’s fame or universe (fan art) or even to its financing. Here, we have a world in which the exploitation of the creator economyis pushed to the extreme, added to a “fandom” so loyal that it also generates fan-to-fanactivities.

These tokeneconomies are managed by the decentralized streamingplatforms or labels and companies that support artists in DAO mentioned before. However, it is possible to consider that artists with a very high profile, or with a sufficiently large and active community, could create their own tokeneconomy outside of dedicated platforms, especially if they wish to create community rules and incentive mechanisms that are different from those allowed on those platforms. The development of these more community-based business models, coupled with unprecedented transparency of on-chainrevenue streams and increased efficiency of intermediation processes, thus increases the bargaining power of upstream artists, especially the most well-known.

Finally, because of their collective and non-profit management mode, the Collective Management Organizations (CMOs) will also eventually switch to a decentralized governance mode based in the blockchain and in which the stakeholders are, at least,all the artists or rights holders subscribing. On one hand, CMOs preserve their role as collectors of royalties and fees due to their members in all off-chaineconomic exploitations that persist in Web 2.0. On the other hand, CMOs do not collect royalties on decentralized platforms, since cryptocurrency flows are directly managed and paid out to rights holders via smart contracts. Nevertheless, OCGs remain central: upstream, they certify, record, and, if necessary, correct the property rights of each person on a unique database that can be “audited” by all and from which smart contractsbetween organizations, artists, and consumers are negotiated, signed, and encoded.

Scenario 2: adoption by installed stakeholders to optimize workflows and capture value

In a second scenario, established players in the music industry appropriate blockchain technology for business and value chain optimization. As with the digital revolution, blockchain would allow intermediaries to further diversify their services and increase value by offering integrated intermediation. In this scenario, labels invest in the partial “blockchainization” of their catalog, focusing for example on new productions. They rely on private or semi-public blockchains in order to implement smart contractsolutions while keeping control of the governance of the data in the blockchain.14This use of the technology by existing players paradoxically involves the suppression of one of the trustlesscharacteristics of the blockchain, namely its decentralized nature. However, such use raises the question of the attractiveness of this solution compared to traditional centralized technical solutions.

In this scenario, the interest of the blockchain lies mainly in its capacity to automate few tasks (e.g., the payment of artists). In this logic of seeking efficiency and relative rationalization of workflows, consortiums are to be expected, involving labels and other existing players (OCGs, streaming platforms, etc.). These private or semi-public blockchain solutions thus enable these players to control the phasing between the on-chain and off-chainworlds and thus preserve their oligopolistic competitive position. For example, the logic of collective rights management would not be called into question but made more reliable and optimized by a blockchain-based declaration register.

The implementation of these solutions, however, requires a real capacity of companies to extend their field of expertise towards blockchain solutions adapted to the workflows and organizational designs of the sector. The acquisition of these skills and technological capabilities can be achieved through the organic growth of players. However, given the still uncertain and evolving nature of blockchain, it is likely that established players would be reluctant to invest heavily in the technology. More likely, the development of players’ capabilities will be through external growth, through partnership approaches with pure playersspecializing in the development of blockchain solutions.

In the same way, blockchain allows the extension of the business models of existing players by enabling them to exploit new sources of value. Thus, a development of the tokeneconomy is to be expected, but with a centralizing role for labels and platforms that keep control of the data and revenue streams generated by these emerging activities while optimizing their economic valuation via cross-externalities with more traditional activities (streaming, concerts, physical media, derivatives, etc.). Once again, the integration of these new activities should take place first via collaborations, or even absorptions, of players in the tokeneconomy similar to those described in the previous scenario. Rather than disrupting the industry, the tokeneconomy thus extends the 360° strategies observed over the last twenty years through an increase in partnerships and collaborations between emerging and established players.

In this scenario, the organization of the value chain is not profoundly challenged, even regarding the actors located further down the value chain. In the absence of full blockchainization of data, the intermediation functions of Web 2.0 streaming platforms remain predominant. Like music labels and publishers, the latter can leverage blockchain to optimize some internal processes or those related to partners such as aggregators (reporting activities, clearance, etc.). In contrast, streaming platforms leaned against blockchain remain confidential and only address some consumer profiles (technophiles or those looking for an “ethical” streaming offer), due to the lack of access to the back catalogsof the main music labels and publishers.

As in scenario 1, blockchain can nevertheless be used as a socio-technical architecture to enhance the value of some niches and independent artists with communities of fans who are highly committed to varying degrees depending on the level of technological and legal maturity considered. More generally, the tokeneconomy constitutes a new lever for artists, but according to a power relationship with intermediaries that remains relatively unchanged.

Scenario 3: Industry disruption with massive adoption of blockchain by new entrants

In this scenario, blockchain technology develops mainly around the tokeneconomy and gigs and is dominated by new intermediaries or social networking giants, with traditional intermediaries confined to the traditional forms of music operation and distribution. This scenario does not really involve anything new in terms of technology or services compared to what has been described above. It is more a question of a different technical and economic configuration between technology, regulation, and the organization of the sector following a gradual but profound change in the behavior and preferences of artists on one hand and the audience on the other hand.

As in scenario 2, this scenario takes note of the many technological, organizational, and behavioral obstacles preventing the harmonization and blockchainization of music data. Under these conditions, only a small portion of the back catalogofthe best-known artists is recorded into the blockchain, allowing for optimized economic exploitation like the methods described in the previous scenario and handled by the established players or by specialized investment funds, such as the Hipgnosis Songs Fund. But on the other hand, new musical productions are “blockchain natives”, regulated and guaranteed by the OCGs, which develop a certification activity as in scenario 1.

Artists, aware of the unfavorable remuneration modes offered by Web 2.0 streaming and increasingly familiar with Web 3.0, are progressively turning towards solutions for creating, distributing, and exploiting their fanbasevia the intermediaries of the tokeneconomy and NFT platforms, but also via social networks that see music as a vector for development (following the example of TikTok’s recent strategy). Correlatively, a growing part of the audience is ready to support, in one way or another, new artists and to interact with them and with other fans, as opposed to a simple demand for free streaming. This trend is also naturally reinforced by a generational renewal that increases the audience’s attraction to new artists who express themselves directly and naturally, like them, in the digital world.

New musical productions thus constitute a basic artistic element from which digital assets are generated that are more or less based on a quasi-community mode of production and consumption between artists and their fans. For the artists involved, remuneration using micropayments for listening represents only one part of the income generated by a tokeneconomy linking digital assets, metaverse, and physical assets. These tokeneconomies are made possible by the fact that the works of these new artists generate far fewer transaction costs because their rights are reliably enshrined in the “marble” of the blockchain.

However, given the maintenance of some technological and regulatory obstacles retained in this scenario, the emergence of these artist tokeneconomies requires specific IT and legal skills to promote and organize the co-production and co-exploitation of these different assets. This involves both providing artists with tools to create, distribute, value and relate to fans and providing fans with simple tools to interact with other fans and artists and support them. As we suggested earlier, these skills are probably more to be found on social networks, which can rely on strong complementarities with their own activities. However, it is not excluded that the new players that have recently emerged in this niche (platforms mixing listening, NFTs, and fan expression) would also dominate the sector by implementing new forms of DAO type intermediation, particularly in line with the co-creation and community philosophy underlying these tokeneconomies.

In any case, traditional industry players—such as music labels and publishers—would remain on the sidelines of this dynamic powered by new artists because the latter, by keeping all their copyright and/or neighboring rights, manage to take better advantage of the blockchain solutions available to them to organize their fan community and their reputation. On the other hand, new intermediaries may emerge in production and publishing, who would be more facilitators of the management of the corresponding rights that the artists would still hold.

In this context, single listening as provided by streaming platforms becomes a more and more negligible part of the value generated by music. New artists, much more inclined to exploit opportunities from the other side of the industry (NTFs, metaverse, etc.), are gradually giving up on a more equitable remuneration of streaming 2.0 listening, which platforms’ revenue streams are structurally insufficient due to ever stronger pressure from the audience for quasi-gratuity. These new artists are thus taking note of the fact that platforms are now only playing a role as “business cards” to their musical universe that they hope to exploit on other fronts, including those provided by blockchain. As a corollary, a small number of streaming platforms can perfectly well continue to prosper and break even through a volume effect on subscriptions.

There remains, of course, the exploitation of a back catalogthat is largely non-blockchainized and therefore still governed largely according to the modalities of the physical world and Web 2.0. This back catalogis gradually being marginalized as it represents a smaller and smaller part of music production and listening. In addition, consumer pressure for near-free access is limiting the possibility for the various intermediaries to generate substantial revenues from it. In this perspective, the value of the back catalogis based, even more than today, on the most popular works that traditional intermediaries exploit according to classic 360° strategies, occasionally supplemented by value propositions stemming from the tokeneconomy, particularly on assets whose rights are reliable and likely to generate revenues that exceed the costs of ex-post blockchainization. However, it is likely that this exploitation would be based on a “simple” engagement of fans, focusing on the patrimonial dimension of the works, as opposed to more community-based logic of co-creation with which neither these artists nor their audience is familiar.

5. Summary of scenarios and conclusion

Starting from a change in the current situation (scenario 0), we have developed three prospective scenarios that differ in the combination of parameters identified. The parameter configurations leading to each scenario are shown in Figure 1. As shown below, if the parameters do not change or change only slightly, scenario 0 could persist and never branch out into the other scenarios. It is interesting to note that in all scenarios, only a limited number of artists can substantially benefit from the new opportunities offered by blockchain, especially those with an established fan community. Similarly, regardless of the scenario, the back catalogis an important resilience factor for established players, at least in the short and medium term. More generally, the trusted third parties in the music industry are not eliminated by the development of blockchain but rather rationalized, admittedly to varying degrees depending on the scenario chosen.

Scenario 1 represents, in a way, the ultimate point of blockchainization of the music industry, completely decentralized and driven by DAOs. However, it assumes a form of “technological solutionism” in which the main drivers of change are the intermediaries themselves—among them the producers, publishers, and OCGs who agree, despite substantial investments and coordination costs, to steer the entire music industry in this direction. Most of the activities in the value chain are then driven by a blockchain architecture and the corresponding value flows are managed by smart contracts.

In scenario 2, which seems more realistic, traditional music intermediaries invest in the field of blockchain upstream (recording, certification, workflow, etc.) and downstream (tokeneconomy, concert, etc.) while continuing to manage the bulk of the distribution of works traditionally (apart from works for which the rights structure is sufficiently well established to be blockchainized). These intermediaries are then able to deploy 360° strategies completed by value propositions from blockchain and Web 3.0 that are standardized and controlled from end to end. Micropayment applications remain marginal, due to the lack of access to backcatalogs. However, the development of tokeneconomies among independent artists or labels and intermediaries located in musical niches to extend and deepen their relationships with their audiences is not excluded.

Scenario 3 represents a sort of reverse pattern compared to scenario 2. The traditional music players, for the reasons mentioned before (impossibility of blockchainizing the catalog, weak pressure from public authorities, transformation of demand) are progressively weakened and may only survive thanks to the exploitation of their back catalogor by struggling in the tokeneconomy market against players from fields more adapted to new technological needs and potential (e.g., social networks). It is therefore the tokeneconomy that provides the bulk of the revenue for new works by exploiting constantly renewed forms of 360° strategies, including on the metaverse.

This highly disruptive scenario describes a process of co-evolution of technology, the property rights regime, and the relationship between artists and the audience that progressively marginalizes the traditional intermediation functions. From now on, artistic work is, at each stage of the process, crossed by logics of co-creation or even co-management with the fans, logics precisely allowed by the technological development of Web 3.0 and democratized via platforms and tools provided by new actors (and/or actors coming from social networks) capitalizing on their technical expertise and network externalities to make themselves profitable.

Just as several technical and economic paradigms have succeeded one another since the Edison cylinder,15Tschmuck P., Creativity and Innovation in the Music Industry, Berlin: Springer, 2012. this scenario 3 would thus lead to a new configuration that would render the current dominant Internet-streaming model obsolete. This raises the question of the gradual shift of new works to the back catalog. Their share is structurally bound to increase as time goes by, even though these works will no longer necessarily be held by the old traditional producer-publisher pair. It is, therefore, possible to conjecture that the established players who have not been able to take the technological turn will no longer be able to make up for their delay by exploiting their increasingly “aging” back catalogand will eventually be replaced by the new players mentioned before.

Two futures on an even more distant horizon can then be sketched from this new configuration: either, as time goes by, the music industry moves towards the all-blockchain, scenario 1 could then become relevant again, or the evolution of music production and consumption practices definitively leads to the end of the traditional organization of the industry (as it was set up during the CD era and inflected by streaming). The community co-production/consumption, with its organization, its adapted rights regime, its specific music styles, and creation processes then becomes dominant from now on… until a new technological revolution…

Translated from French by the authors, edited by Anne-Sophie Guénéguès

- 1Management of contributions and contributors to recording, mixing, mastering, sampling, etc.

- 2Most applications use the Ethereum protocol, which is well documented on the web and for which development support is provided by a large and active community. Bitcoin is more rarely used, as are proprietary solutions and, more recently, a coupling between Solana blockchain and Arweave storage system.

- 3Watermaking creates and links to the audio file a dotBC URL referring to a series of minimum viable data (such as song title, artist, publisher, ISRC, ISWC, etc.) stored into the blockchai

- 4For a detailed description of the operation, which, with a total revenue of $133.30, ended in commercial failure attributable to the immaturity of both the technical side and listener purchase patterns, see ConsenSys Media, “Evolution of Ujo Music: The Tiny Human Retrospective,” November 7, 2016, online: https://media.consensys.net/evolution-of-ujo-music-the-tiny-human-retrospective-e23136197c31

- 5The gas is the unit in the Ethereum blockchain paid by the user who wishes to make a transaction, to the miner who validates the transaction according to the consensus provided by the Ethereum protocol. The cost of the transaction is calculated according to the computing power necessary to carry out the operation. This system of operation of the Ethereum blockchain can be compared to the way an electricity bill is calculated: each use of a household appliance is associated with a certain amount of electricity consumption expressed in kilowatt-hours (the gas) which finds its equivalent in euros (the price of the gas, expressed in fractions of ether, called gwei).

- 6We could add to this panorama the applications supporting the development of the Internet of Musical Things (IoMusT) suggested by L. Turchet but for which we have not yet found any exemplary application. See Marellapudi T. S., “What is the Internet of Musical Things (IoMusT)?”, All about Circuits, April 24, 2020, online: https://www.allaboutcircuits.com/news/what-is-the-internet-of-musical-things-iomust/

- 7Evolution of the Internet towards a virtual world, based on 3D computing, virtual and/or augmented reality, made up of shared and persistent spaces where users interact via avatars.

- 8The rationale for stablecoins is to take advantage of low volatility, for example through indexing to traditional assets (monetary or otherwise). However, this indexation creates problems of transparency and confidence in the commitment of issuers to ensure the stability of their stablecoinsby having sufficient reserves of assets.

- 9About forty parameters were thus identified and gathered into seven main categories: The possibilities and limits of blockchain technology (computing capacity, time required for consensus proofs…), the governance of blockchains (possibility of ex-post correction, interfacing of platforms…), the governance of music industry data and metadata (standardization, quality control at entry…), the legal and regulatory framework of blockchains (stability or harmonization of tax rules on the resale of NFTs…), other regulatory aspects (evolution of copyrights…), adoption and appropriation behaviors by fans and adoption and appropriation behaviors by artists.

- 10See the agreement between Universal and the NFT Curio platform, or between the blockchain video game The SandBox and Warner.

- 11Anderson C., “The Long Tail,” Wired, October 1st, 2004, online: www.wired.com/2004/10/tail

- 12Hu C. and Jackson B., “Music/Web3 Dashboard: $160M + worth of music NFT sales, plus music DAOs and creator tools”, Water & Music, January 9, 2022, online: www.waterandmusic.com/data/music-web3-dashboard/

- 13Seabrook J., The Song Machine: Inside the Hit Factory, New York: W.W. Norton & Company, 2015.

- 14This use of the technology by existing players paradoxically involves the suppression of one of the trustlesscharacteristics of the blockchain, namely its decentralized nature. However, such use raises the question of the attractiveness of this solution compared to traditional centralized technical solutions.

- 15Tschmuck P., Creativity and Innovation in the Music Industry, Berlin: Springer, 2012.